Tripura is witnessing a downward trend in cyber fraud incidents, according to Director General of Police Anurag Dhankar. So far, 269 people have fallen prey to such crimes, resulting in a cumulative loss of Rs 51.49 crore.

Despite the substantial financial impact, DGP Dhankar emphasized that increased public awareness has contributed to a gradual decline in these cases across the state.

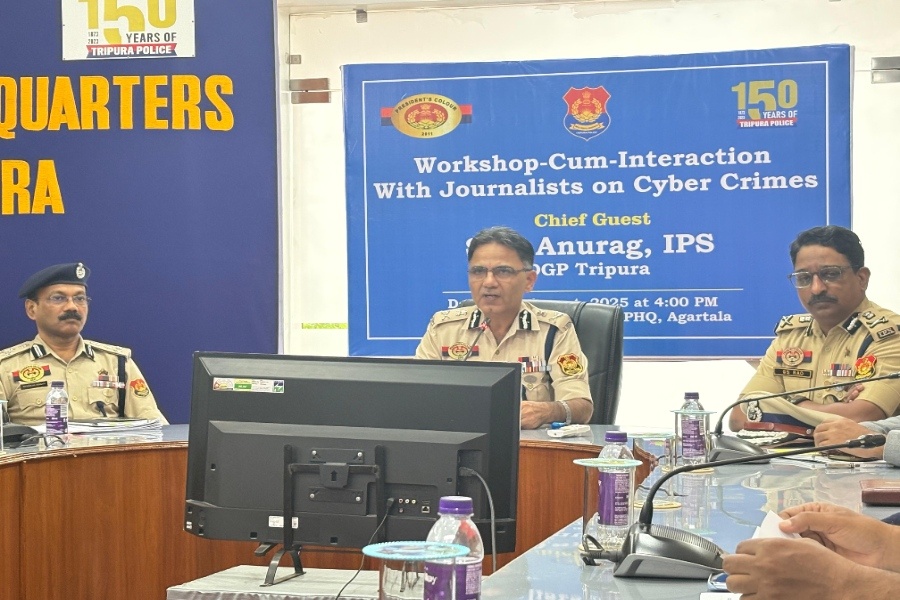

At a press briefing held at the Tripura Police Headquarters, the DGP provided detailed insights into the current cybercrime scenario. He noted that criminals are increasingly targeting citizens through fake electricity and gas bills, RTO challans, and fraudulent investment schemes.

Other emerging threats include impersonation scams involving police or income tax officials, bank frauds through OTP theft, social media harassment, fake franchise operations, lottery scams, and manipulation of platforms such as OLX, courier services, and hotel bookings.

“Cyber fraud is a rising concern nationwide, impacting ordinary users and even cyber professionals,” DGP Dhankar said. With over 850 million Indians now regularly online, opportunities for cybercrime have grown significantly.

In Tripura alone, 269 victims have reported losses totaling Rs 51.49 crore. Authorities have so far recovered Rs 33.84 lakh and frozen 20,387 bank accounts containing approximately Rs 5.76 crore, which is expected to be retrieved within the next three months.

A year-wise breakdown shows a gradual improvement in tackling cyber fraud: Rs 1.98 crore in 2021, Rs 4.62 crore in 2022, Rs 9 crore in 2023, Rs 25.54 crore in 2024, and Rs 9.77 crore recorded until July 2025.

The DGP urged citizens to adopt proactive measures to safeguard themselves online. Recommended precautions include installing only necessary apps, using strong and unique passwords, regularly updating them, and ensuring that calls or SMS are not forwarded without permission. Any suspicious transactions should be reported immediately by calling 1930 or contacting local police or the Agartala Cyber Crime Police Station.

Authorities also warned against purchasing products through social media ads, responding to unsolicited “work from home” offers, participating in unauthorized online games, or mismanaging UPI transactions, especially for Common Service Centre (CSC) owners, as these could lead to financial loss or account freezes.