Aiming to enhance ease of living and simplify compliance for taxpayers, the Union Budget 2026–27 announced a series of direct tax reforms, including the implementation of the new Income Tax Act, 2025, from April 1, 2026.

The government said simplified rules and redesigned forms will be notified in due course, giving taxpayers sufficient time to familiarise themselves with the new requirements. The updated forms are intended to make compliance easier, particularly for ordinary citizens.

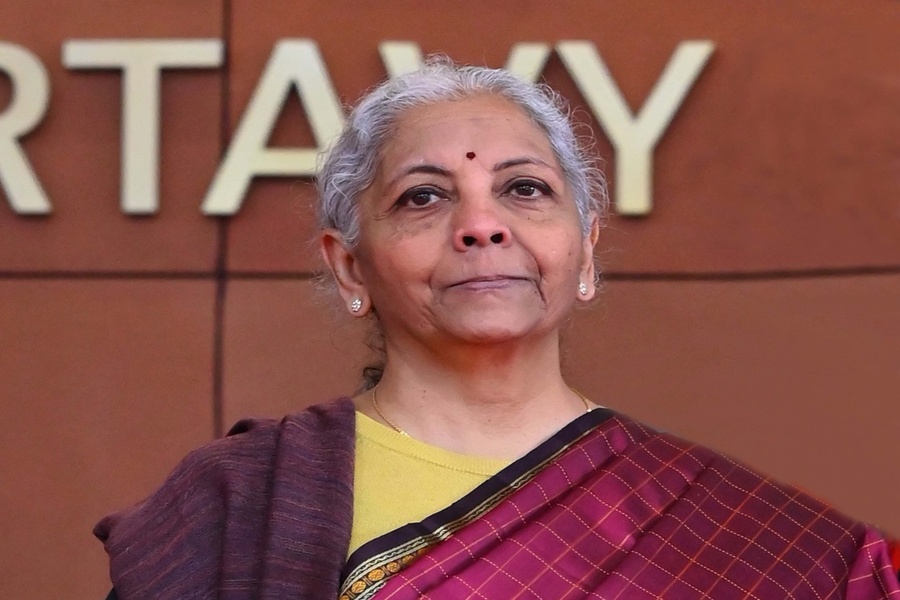

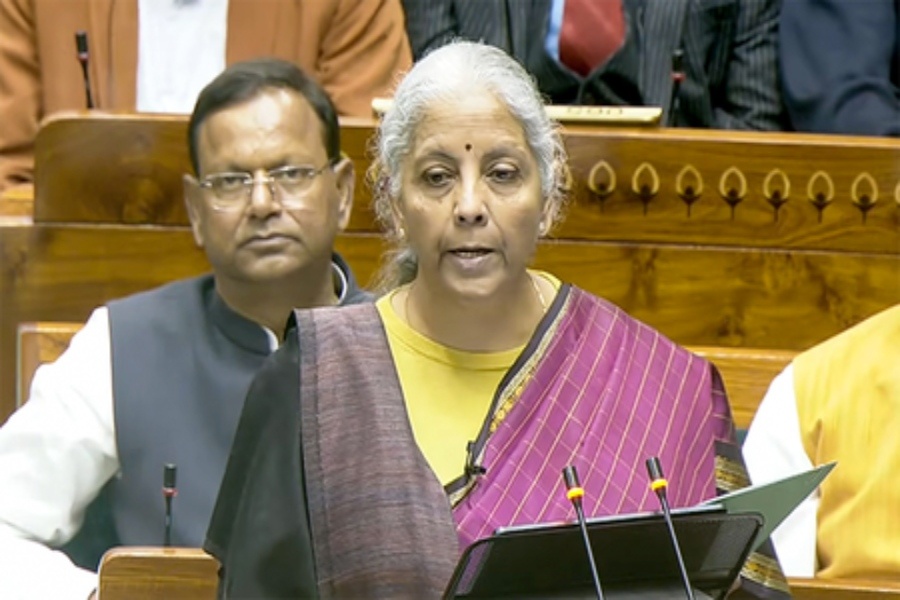

Finance Minister Nirmala Sitharaman also announced that interest awarded by the Motor Accident Claims Tribunal to natural persons will be exempt from income tax, with the removal of Tax Deducted at Source (TDS) on such payments.

Under the proposed changes, the Tax Collected at Source (TCS) rate on overseas tour programme packages will be reduced from the current 5 per cent and 20 per cent slabs to a uniform 2 per cent, without any minimum amount condition. Similarly, the TCS rate for remittances made for education and medical purposes under the Liberalised Remittance Scheme (LRS) will be lowered from 5 per cent to 2 per cent.

To remove ambiguity, the Budget proposes to explicitly include manpower supply services under payments to contractors for TDS purposes. As a result, TDS on such services will be levied at 1 per cent or 2 per cent, as applicable.

For small taxpayers, a new scheme is proposed to enable a rule-based automated process for obtaining lower or nil TDS certificates, eliminating the need to apply to the assessing officer.

To simplify compliance for investors holding securities across multiple companies, depositories will be allowed to accept Forms 15G and 15H and directly share them with the concerned companies. The Budget also extends the deadline for revising income tax returns from December 31 to March 31, subject to payment of a nominal fee.

The timeline for filing tax returns will be staggered, with individuals filing ITR-1 and ITR-2 continuing to have a July 31 deadline, while non-audit business cases and trusts will be allowed time until August 31.

Additionally, TDS on the sale of immovable property by non-residents will now be deducted and deposited using the resident buyer’s PAN-based challan, removing the requirement for a Tax Deduction Account Number (TAN).

Addressing compliance challenges faced by students, young professionals, technology employees, relocated NRIs and others, the Budget proposes a one-time six-month foreign asset disclosure scheme. The scheme will apply to taxpayers who failed to disclose overseas income or assets, as well as those who paid due tax but did not declare the assets acquired, provided the income or assets are below a specified threshold.